When everyone's predicting a crash, what does the data actually say?

You’ll have no doubt read the chorus of headlines predicting the bursting of the AI bubble.

Last month Jamie Dimon of JP Morgan described himself as “far more worried than others” about a "serious market correction" within the next 6 to 24 months. Others have followed suit, raising concerns about overvalued equities, AI-driven bubbles, and unpredictable policy decisions from the US.

For advisers, these headlines create a familiar challenge: clients hear the warnings and start asking questions. Should we reduce equity exposure? Is it time to de-risk? Are we sitting on gains that could evaporate?

Even with the usual reassurances to "keep calm and carry on", there's likely still a nagging feeling that this time might be different. And while that advice may eventually prove sound, it's essentially passive – asking clients to trust that markets will recover, without any active mechanism to protect them if they don't.

This is where Crossing Point's "trend-guided" approach, with Guardian and Fusion portfolios, offers something more. We combine the cost efficiency and diversification of investing into a mix of passive and active funds with active trend-following overlays that respond to changing market conditions. We don't make investment decisions based on headlines or gut feelings. We follow the data. And right now, our trend-following analysis isn't telling us to change course.

That means you can tell clients with genuine confidence: we're monitoring markets systematically, we have clear signals that will trigger action if needed, and we've successfully protected capital through multiple crises using this exact approach. Not just reassurance - but evidence-based reassurance.

What the trend data is actually saying

Despite the nervous commentary, our trend-following indicators remain firmly positive on equities. The signals that would prompt us to reduce exposure simply aren't there yet.

This doesn't mean we're ignoring the risks. We're watching markets closely, particularly for our Guardian and Fusion portfolios where downside protection matters most. But we're disciplined about waiting for genuine trend reversals rather than reacting to noise.

This is the entire point of trend following: it removes emotion from the equation. When the data says markets are still in a positive trend, we stay invested. When that changes – and it will at some point – we'll act decisively.

Why our approach is different from typical trend following

A recent conversation with an adviser highlighted an important distinction. He'd previously used a trend-following provider that relied on one longer-duration moving average crossover. When Trump’s tariff announcements hit the markets earlier this year, that system wouldn’t have signalled an exit until it was too late to avoid significant losses. More problematically, it would have kept them out of the market well into the recovery.

Our approach is more dynamic. We don't rely on a single lagging trend indicator. Instead, we combine multiple trend signals with market sentiment analysis, giving us earlier warnings and faster re-entry signals.

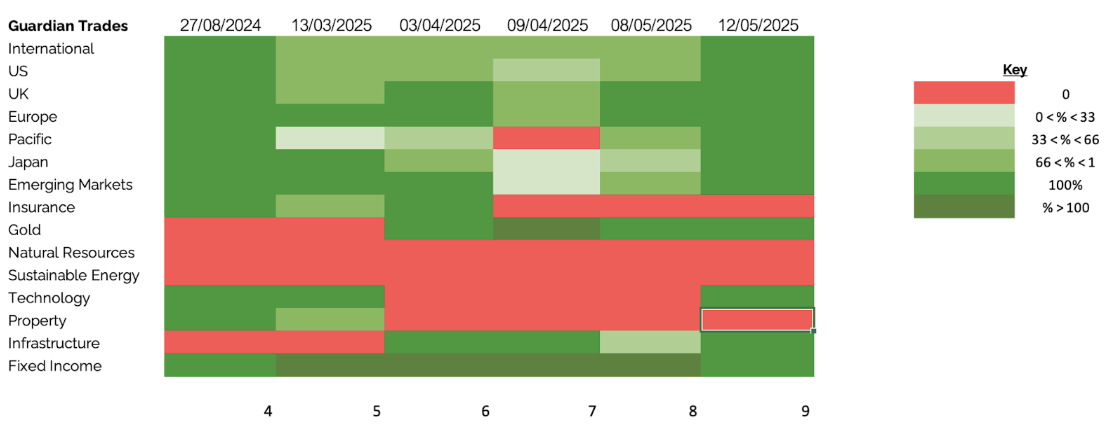

During the tariff volatility in the spring of 2025, we made three distinct rounds of adjustments as the situation evolved:

13th March (Early trend response to tariff concerns): Initial response – reduced exposure to global small caps and FTSE 250, trimmed US equities, cut Pacific exposure, and lowered insurance and property allocations.

3rd April (The day after the tariff announcement): As some tariffs were renegotiated while others became entrenched, we shifted international equities towards research-enhanced and income strategies, added equally-weighted and value funds in the US, removed FTSE 250 entirely while increasing FTSE 100 exposure, added gold as a hedge, replaced property with infrastructure, and increased defensive fixed income allocations including inflation-linked bonds.

9th April (Effective tariff day): As equity markets fell sharply and uncertainty peaked, we took more defensive action – significantly reducing UK, European, Japanese and emerging market equities, removing Pacific equities, insurance and government bonds entirely, while increasing gold and short-term bonds and adding European government bonds and money markets.

2nd May (Early trends to re-enter): When our trend analysis showed early signs of a positive shift, we moved decisively to increase exposure – raising allocations across international, US, UK, European, Japanese and emerging market equities, re-introducing Pacific equities, increasing infrastructure, while reducing our defensive positions in gold, short-term bonds and money markets.

This is what dynamic risk management looks like in practice: not binary "all in or all out" decisions, but nuanced, evidence-based adjustments that respond to changing conditions. More importantly, we were back in the market by early May – while many trend-following systems using slower indicators would have kept advisers and their clients sidelined well into the recovery.

In March and April, our trend-following portfolios stepped out of the market before re-entering equities in May. While remaining fully invested through this period would have produced stronger short-term gains, the Guardian and Fusion portfolios are designed first and foremost to protect clients’ capital. That discipline remains central to our approach.

If President Trump hadn’t reversed course on his tariff announcement, markets could have continued to fall sharply. In that scenario, stepping aside temporarily would have been crucial to avoid deeper losses. Our disciplined approach ensures that, even when the markets surprise us, client protection remains at the heart of every decision we make.

Over the longer term, as evidenced from our Guardian portfolios, this disciplined trend-following process has delivered consistently strong results, combining high returns and superior risk-adjusted performance with lower volatility and smaller drawdowns compared to benchmarks. By focusing on risk management and systematic decision-making, our portfolios aim to capture sustained growth while keeping the journey smoother for investors, demonstrating that a thoughtful, evidence-based approach can outperform over time without taking unnecessary risks.

This same disciplined approach guided us through Covid in 2020 and the Ukraine invasion in February 2022. Our trend system responded quickly to protect capital, then got us back in as conditions stabilised.

What happens next?

Looking ahead, 2026 could bring fresh challenges. Rising unemployment, persistent inflation, and the delayed impact of tariff policies could all weigh on equity valuations. We're not complacent about these risks.

But right now, the trend data doesn't support defensive positioning. Our portfolios remain constructively positioned in equities because that's what the evidence tells us to do. When the evidence changes, we'll change with it – not before.

This is the discipline that trend following provides – it's systematic, evidence-based, and most importantly, it works.

The real value for advisers

For advisers using Crossing Point, trend following provides something invaluable: a clear answer to the "What are you doing about this?" question.

When clients call concerned about market headlines, you can explain with confidence:

We have systematic risk controls in place.

We're monitoring multiple data points daily.

We'll act when the evidence supports it – but not before.

This approach has protected capital during previous crises while capturing recovery gains.

That message demonstrates active risk management grounded in data.

And crucially, it aligns perfectly with Consumer Duty requirements around foreseeable harm. You're not passively hoping markets don't fall. You're actively managing the risk, with clear evidence of your process.

So while the headlines are certainly nerve-wracking, it’s worth remembering that feelings and headlines aren't investment signals.

Crossing Point's trend-following approach has guided portfolios successfully through five years of crises, volatility, and uncertainty. It kept clients invested when opportunities were strong and protected capital when risks were genuine.

At the moment it's telling us to maintain our positioning. When that changes, we'll communicate it clearly and act decisively. That's the commitment - and the competitive advantage - that trend following provides.

If you'd like to understand more about how our trend-following methodology works in practice, or see the detailed performance through recent market crises, please email Carl Hagger, our Business Development Manager.